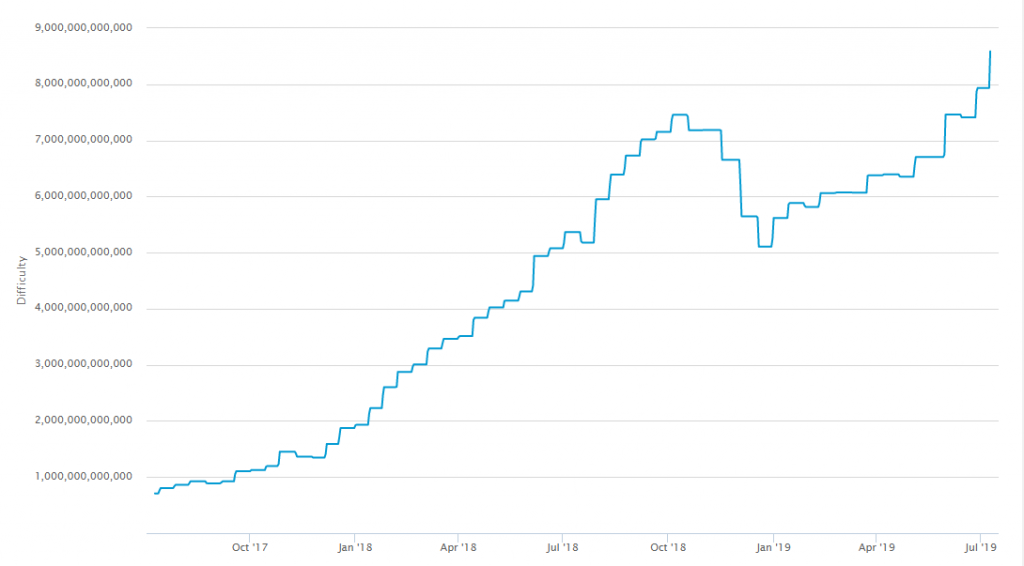

Bitcoin mining difficulty indicates how much computing power you should use to create a new bitcoin block. Each contribution is rewarded with bitcoins. The Bitcoin Mining Difficulty has posted a significant two-week rise, the biggest in 12 months.

It reached a level of 9.03 trillion (T), according to BTC.com, at block height 584,640 on July 9th at 9.17 UTC. This surpassed the previous high of 7.93T by a staggering 14.23%. It was the most substantial growth in any given 2-weeks since last August. This is undoubtedly a sign that mining competition is intensifying as well as doing it at an increased rate.

Every 2,016 blocks (which is usually 14 days), the bitcoin network adjusts its mining difficulty as it is designed to do. This is based on the mining power available in each cycle to make sure the time for block-producing for the next time-frame remains at around every 10 minutes.

When fewer machines compete to solve the hash function of bitcoin to earn new bitcoins, the level of difficulty falls. If more jump in, there’s an increase in difficulty.

There’s fierce competition right now meaning the level of difficulty has jumped up over the 8 trillion range and has broken the 9-trillion threshold. The BTC.com estimated the pressure at the coming adjustment period might be at much as 10.35 trillion – that’s another increase of 14.14%.

In the same way, there’s also considerable growth in the amount computer power that’s been dedicated to securing the network, logging the biggest two-week growth of any adjustment cycle since almost a year ago on August 2018. This is based on CoinDesk’s calculations and BTC.com data.

The enthusiasm for mining bitcoin has shoved the hash rate up to 74.5 quintillion hashes a second (EH/s) as of late last week (July 5th). This is in line with mining farm predictions in China that have plugged in more machines to benefit from cheaper hydroelectric power in their summer rainy season.

The overall hashing power should continue to rise as the raining season hits its peak in a few months in southern China, which is an area that is said to account for around half of the global mining of bitcoin.

There was a significant hit to the bitcoin mining difficulty last year when the market took a downturn. It went down by up to 30% between October and December and then managed to get back to its previous high just last month.

The bitcoin hash rate increase and increase in mining difficulty haven’t yet caught the bottom of the bitcoin price jump pace, unlike the way they did during the latter half of 2017 in the bull run.

Bitcoin’s Price Index data, the price coursed up by 400% from $4,000 to almost $20,000 in between the June to December period in 2017. In this very same period, there was also 200% growth in the computer power of the network.

While the price of bitcoin increased up to $12,000 last month (a jump of 300% since its fall to $3,000 a few months ago), the hash rate of the network has seen a lesser increase of just 100% in the same time.

The lag is due to a lack of new mining equipment for bitcoin to meet the needs of the market since the famous miner makers have hit a production capacity bottleneck due to a lower supply of the chips from semiconductor vendors.