Let’s celebrate. Since yesterday everyone can trade cryptocurrency contracts. No expertise nor large investment needed. PrimeBit WebTrader is a groundbreaking tool that democratizes crypto futures trading removing the most prominent obstacles. Now everybody can exchange peer-to-peer contracts.

PrimeBit WebTrader is easy to use for non-experts. Thanks to the highest maximum leverage available on the market, investors with little funds can successfully compete with the most affluent traders. Only on PrimeBit, you can buy (or sell) a bitcoin, ethereum or litecoin contract worth $20,000 with just a $100 deposit.

Trading with the new PrimeBit WebTrader is very easy. Let me guide you step by step through the process.

Three main sections of the app

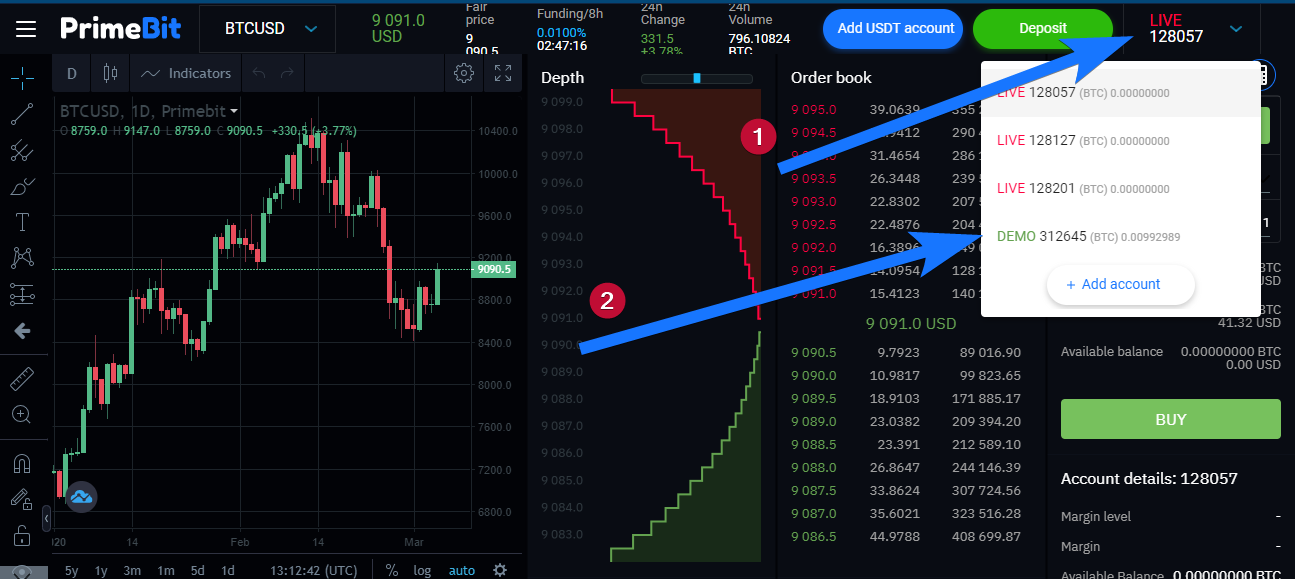

Go to app.primebit.com and sign up for the PrimeBit WebTrader. All you need is to verify your email. Start trading with a DEMO account with virtual money:

- Go to the accounts drop-down menu

- Pick a DEMO account.

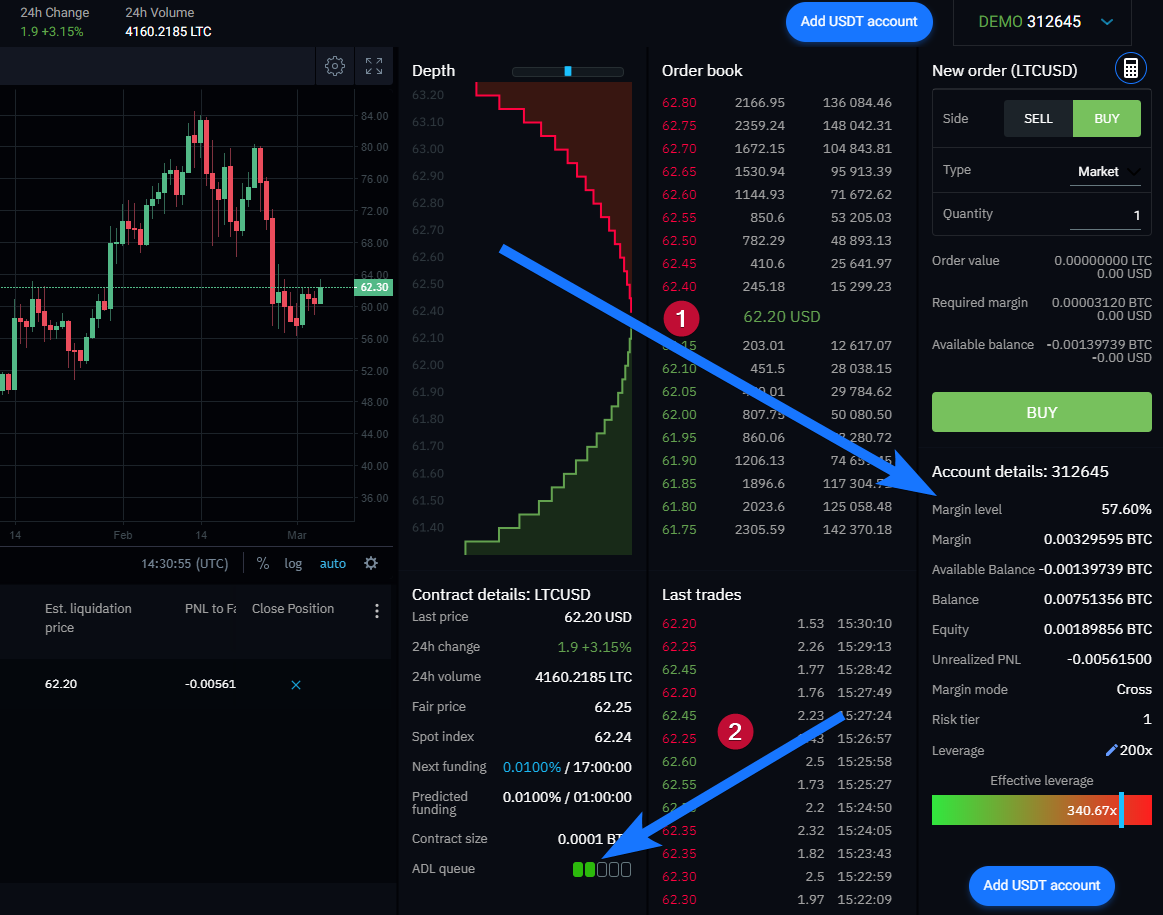

There are three main sections of the PrimeBit WebTrader:

- On the left, you can see the market chart, where you can analyze the historic prices with over 50 technical analysis tools and indicators. The price you see in the chart is a “fair price” indicator. Analyze the chart and create your trading strategy. Now you should have your opinion on whether the price should go up or down.

- In the middle part of the application, you can see the market “Depth” and “Order book”. In the “Order book” you can see the price offered, the number of contracts offered, and the value of the order. You can click any order to pick it up.

- The right-hand side of the app is for placing orders. Here you can BUY or SELL your contracts. Buying means opening a long position, where you expect the price to rise, while selling stands for opening a shot position, where you will profit from the price going down.

Placing orders

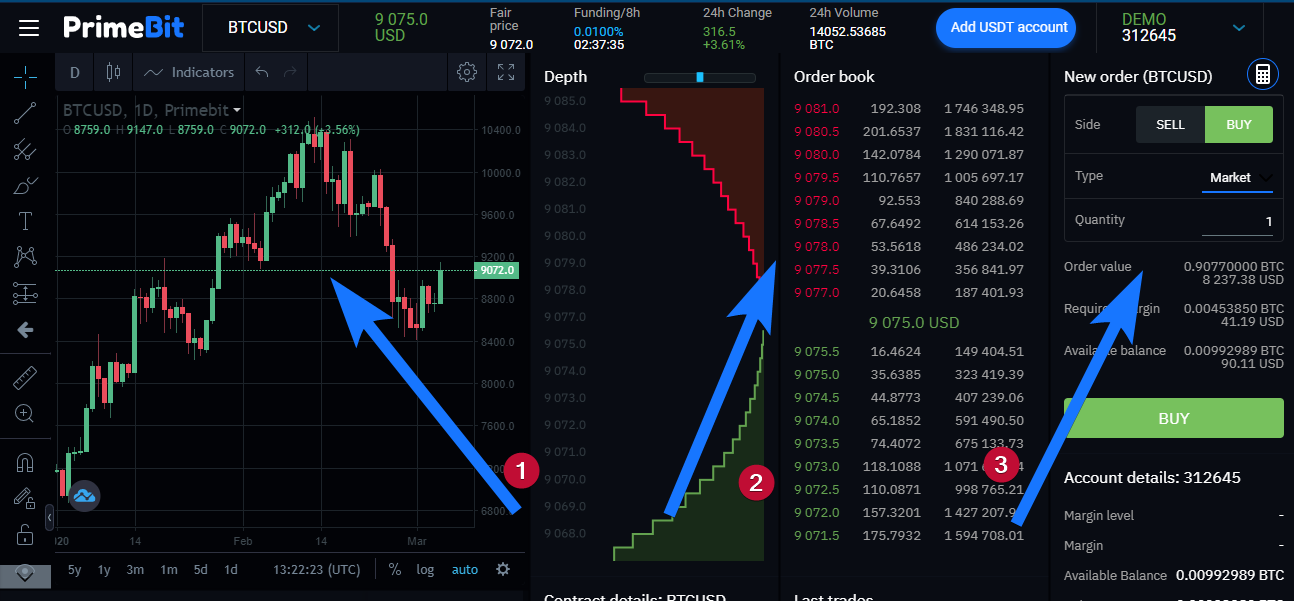

First, choose the pair you want to trade. At the moment on PrimeBit you can open two types of accounts:

- Bitcoin accounts, where you can trade BTCUSD, ETHUSD, and LTCUSD.

- Tether accounts, where you want to trade BTCUSD, ETHUSD, and LTCUSD.

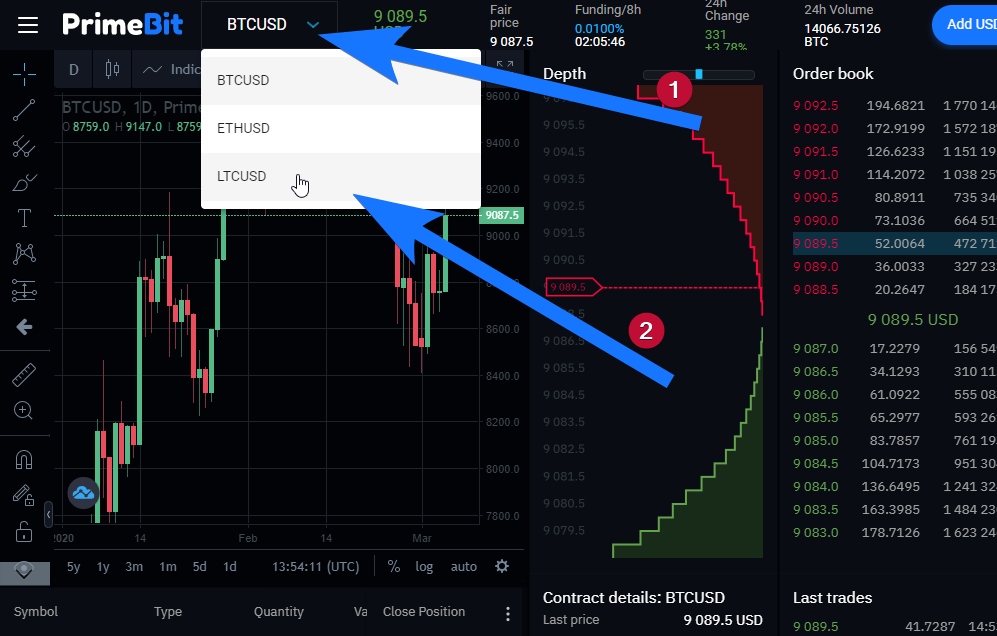

In this case, I’m trading with a bitcoin account. I click the “BTCUSD” label to expand the drop-down menu. Let’s trade LTCUSD!

Making a market order

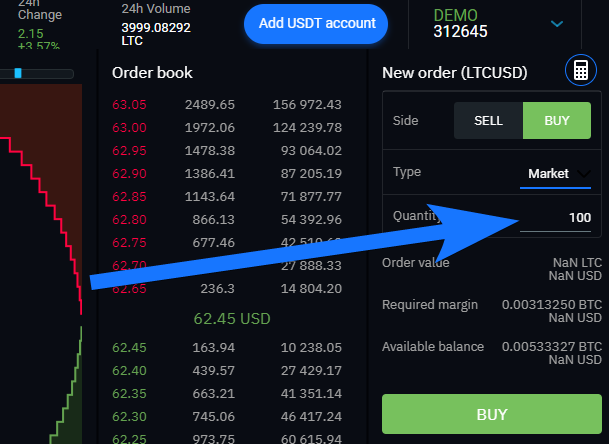

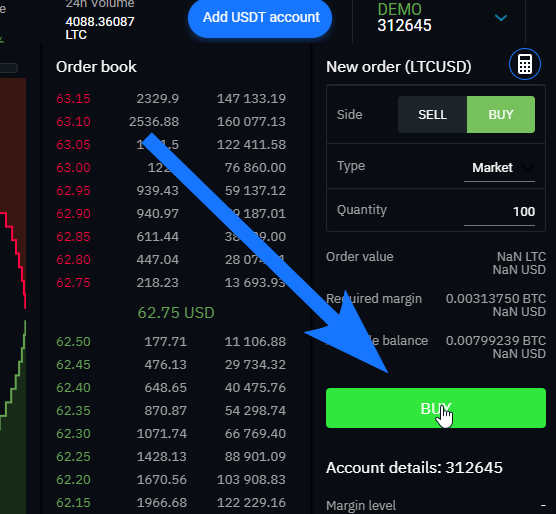

Select “SELL” to short an asset or “BUY” to take a long position. I pick “Market” from the “Type” menu.

I’ll go for 100 LTCUSD contracts.

The required margin is only 0.00313750 BTC since this is my DEMO account with a 200x leverage.

To place the order I click the buy button. You can see your active positions in the table under the chart. You can close them clicking the “x” button.

Making a stop-loss order

Everything looks fine so far. If you don’t want your position to be liquidated, set stop-loss order. PrimeBit is operating in an exchange model where a stop loss is a stop order.

For a buy order, stop-loss needs to open on the opposing side of the trade. Since we made a BUY order, the stop loss is a sell stop order. Choose “Stop” your order “Type”. In our case stop loss will be below the current BTCUSD price. Your order quantity should be the same as for our initial buy order.

Your stop loss will be visible in the pending order tab. Perfect!

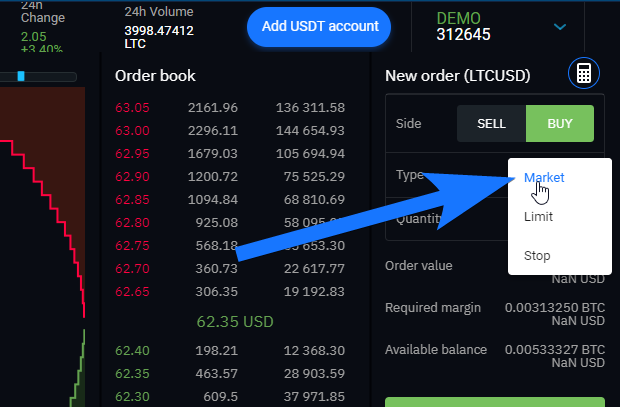

Adding your offer to Order book

Another way to trade with PrimeBit is to add your offers to the “Order book”. This is easy. Choose “Limit” for your order “Type”, type in quantity, and set the price you want.

I used a lot of funds to open my first position, so now I’ll just place an order for one contract. I want the “Limit price” to be attractive to the other side of the contract, so someone will pick it up. I want it to happen because on PrimeBit you earn a commission, so-called “maker fee” if somebody picks up your order from the book. That’s why I offer 62.65, so people can enter a short position (SELL) at the best (highest) price available at the moment. I click the “BUY” button and my order jumps at the highest position in the “Order book”.

Auto deleveraging (ADL) system

Unlike the main competition, PrimeBit does not run an “Insurance fund”. We don’t collect any bitcoins from our users to keep them away in a vault. If you have too little funds, your position will be automatically closed.

Margin level is the key to understand ADL. The margin level is the account’s equity divided by the required margin expressed in percentages. If the margin level drops to 50% or below, PrimeBit will trigger the ADL procedure.

The same will happen when you find yourself at the head of the ADL queue.

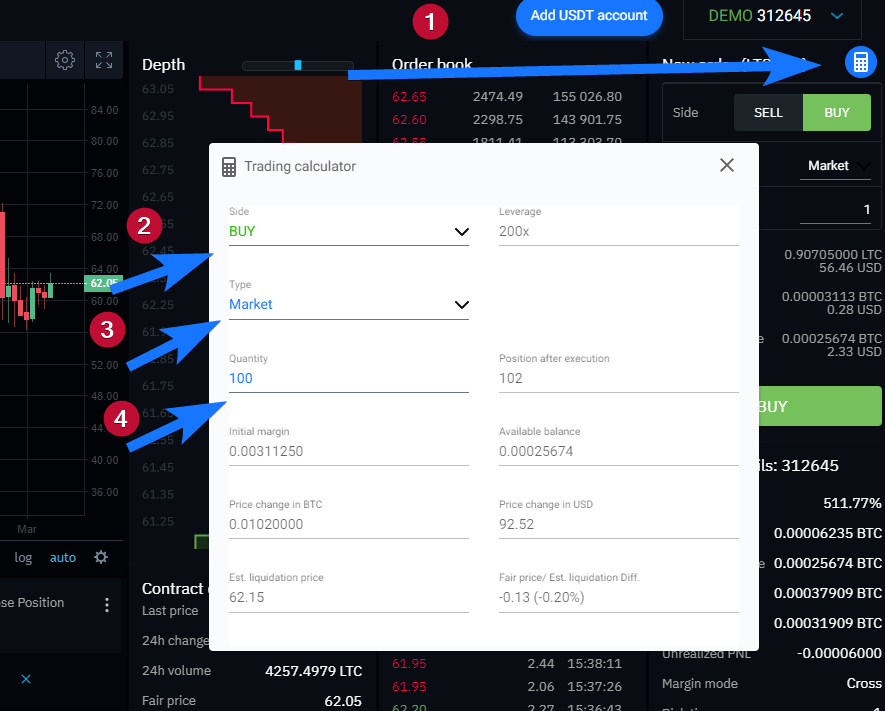

Before you place an order you can check the estimated liquidation price using the PrimeBit calculator. You will find it in the top-right corner of the app. Just select the side you are considering (BUY/SELL), the order type, and the number of contracts. The calculator takes into consideration your available deposit and will give you the straight answer when you may expect your position to be deleveraged.

Cryptocurrency contracts are great financial investment tools. Trading on PrimeBit you get access to unlimited profits with a capped downside. If you find yourself on the right side of the market you will earn a linear payoff perpetually. The higher the leverage you use, the bigger the reward. On the other side, if the market goes against you, your loss is limited to the size of the deposit, and the platform is protected by the ADL system.

Give PrimeBit WebTrader a try, and you will find out that trading crypto contracts is much easier than you thought.

Here’s our video guide for desktop users:

And those trading on mobile: