Cryptocurrency contracts trading is becoming mainstream, as traders want to make profit no matter if the market is rising or falling. The crypto market volatility allows traders to capitalize on the price fluctuations of Bitcoin, Ethereum, and other cryptocurrencies. And with leveraged trading, the profit potential is endless.

PrimeBit is the leading peer-to-peer crypto contract trading platform that offers a 200x leverage on any of its contracts–the highest on the market. Its fair price marking, non-expiring arrangements, and lucrative affiliate program are unbeatable, providing more chances to amplify gains.

How To Profit with Leveraged trading?

Leveraged trading is a means for traders to maximize profit by increasing their buying power through borrowed funds. With more funds at their disposal, traders can enter more significant positions and expand their trading portfolio, thereby generating more promising yields.

Suppose you have 1 BTC in your account. When you trade 1 BTC at 10x leverage, you can enter a more significant position worth 10 BTC with only 1 BTC as your margin (the amount in your account that is needed to open a post). At 200x leverage, it will be worth 200 BTC. Thus, when the market is favorable, you can gain 10x to 200x more profit. With leverage trading, you can also diversify your trading portfolio by trading in more contracts such as BTCUSD, ETHUSD, and LTCUSD.

In trading crypto contracts, traders can open long or short positions. Your decision points to whether the price of a cryptocurrency will rise or drop. Going long means that you will open a long position and buy a contract because you believe that the price will go up. Conversely, going short means that you will open a short position and sell a contract because you think that the price will go down, and you plan to repurchase it in the future when the price is low.

The best thing about leveraged trading is that when the market turns to your favor, your earnings can easily magnify. But when things go sideways, you only lose your initial capital.

Leveraged Trading on PrimeBit

The PrimeBit Webtrader is an easy-to-use trading platform equipped with both basic and advanced features to help traders plan their trades. It has integrated MetaTrader 5, which is the holy grail among traders around the globe.

Step 1. Sign-up for a PrimeBit account.

Creating an account is simple. Just head on to the PrimeBit website and sign-up using your email address. After signing up, you will receive a verification email containing a verification button. Click on that, and you’re done. Don’t forget to set a strong password.

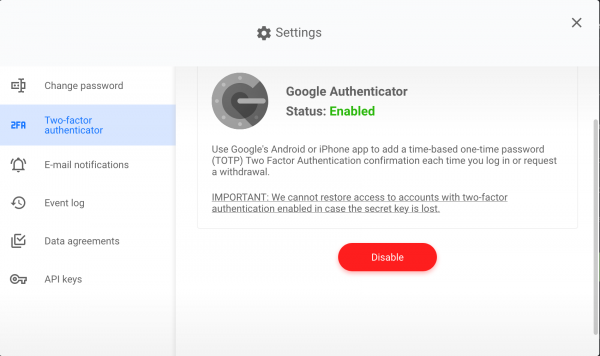

Enable the two-factor authentication to keep your account secure. You can do this at the “Settings” found on the main menu beside the PrimeBit logo.

Step 2. Deposit funds to your live account.

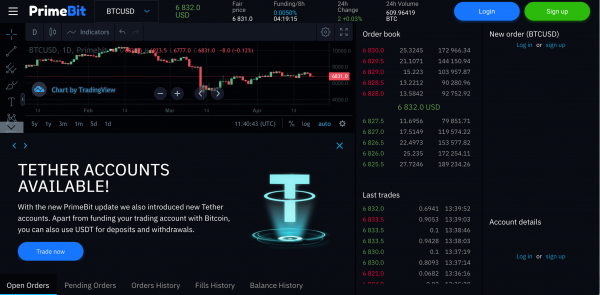

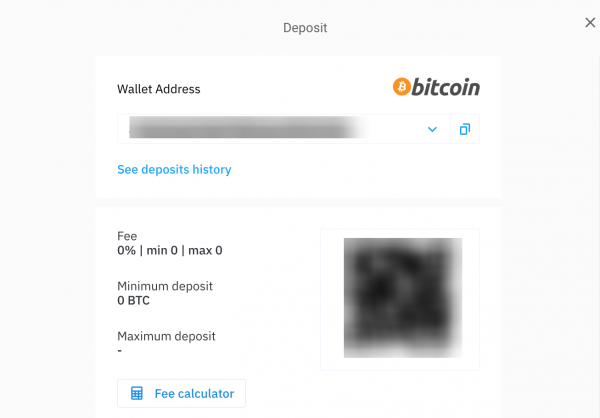

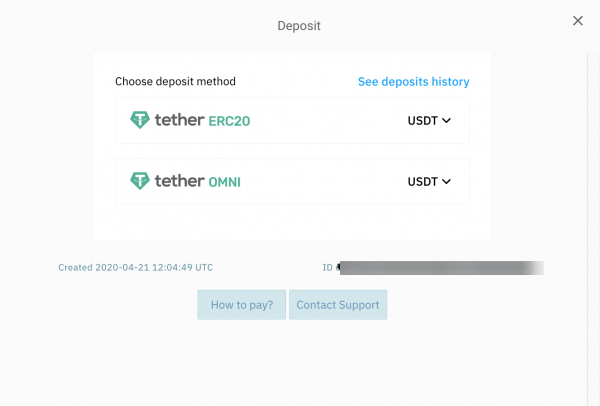

PrimeBit gives you a live account and a free, fully-featured demo account. To deposit funds to your live account, click on a live account. You can create an account or choose among your accounts via the drop-down accounts menu on the upper right corner of the page. Then, click the green “Deposit” button. You can deposit in bitcoin or Tether (ERC20 or Omni). Choose your desired payment method and send your funds from your wallet to the corresponding address displayed on the payment window.

Making a deposit is free, and there is no minimum/maximum amount. You can also see your past deposit transactions on “See deposits history.”

Step 3. Proceed to the main trading page.

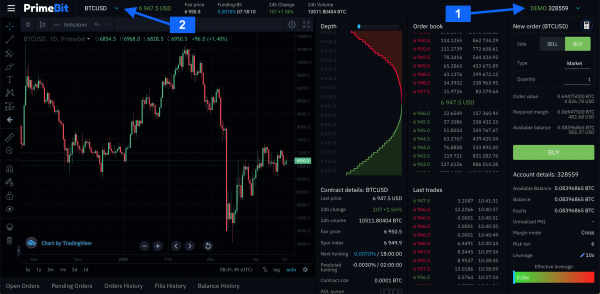

To start a trade, choose a live account or a demo account. Then, click on a contract that you want to trade. PrimeBit offers six types of contracts: BTCUSD, BTCUSDT, ETHUSD, ETHUSDT, LTCUSD, and LTCUSDT.

Step 4. Enter your order details.

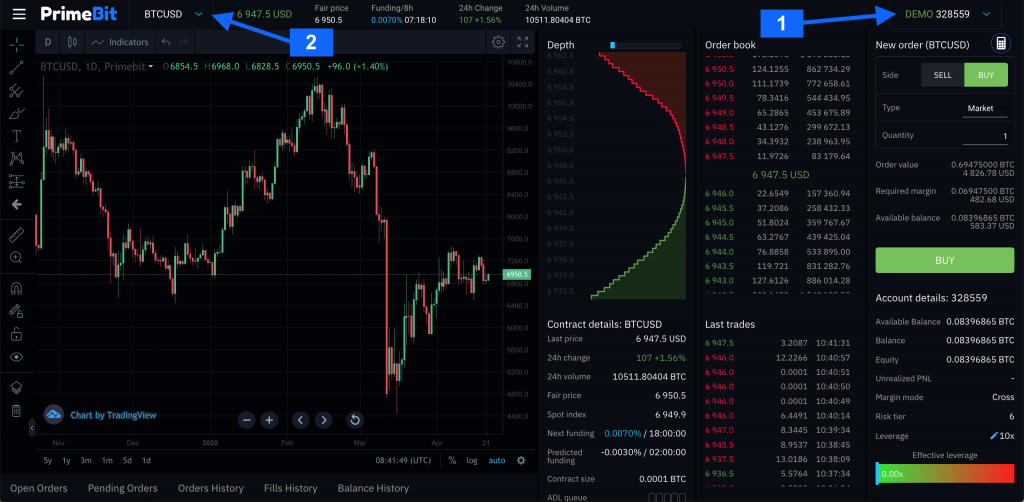

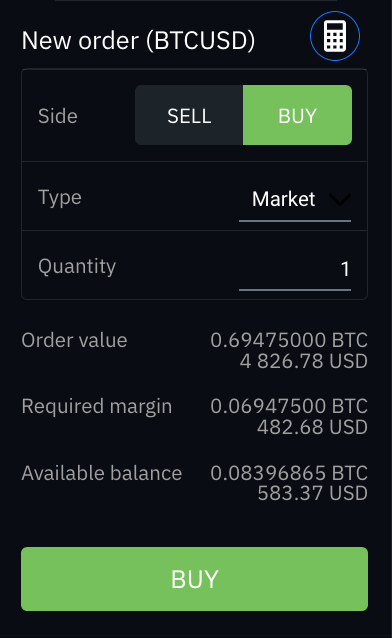

The main page presents analytic charts and tools on the left side, and the Order book and New Order panels on the right side. On the New Order panel, you can set a market order, a limit order, or a stop order. In this example, we will open a long position (buy) and set a market buy order of 1 BTCUSD.

Step 5. Set your leverage.

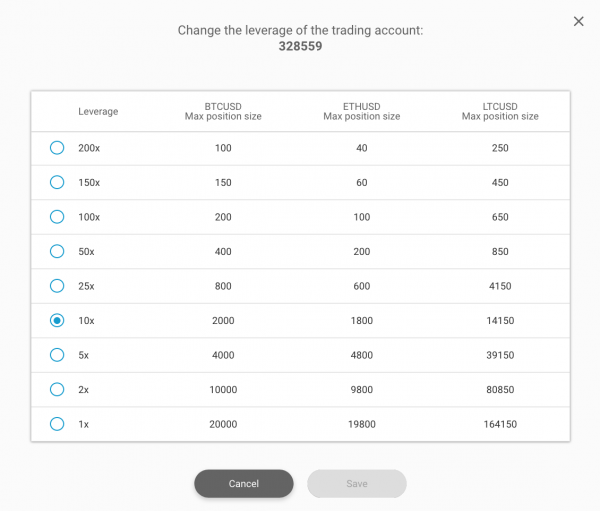

PrimeBit offers nine leverage settings of 1x, 2x, 5x, 10x, 25x, 50x, 100x, 150x, and 200x for all 6 contracts. The available margin depends on your position size and the currency pair. For example, to trade BTCUSD, you can use 200x leverage for a maximum position size of 100.

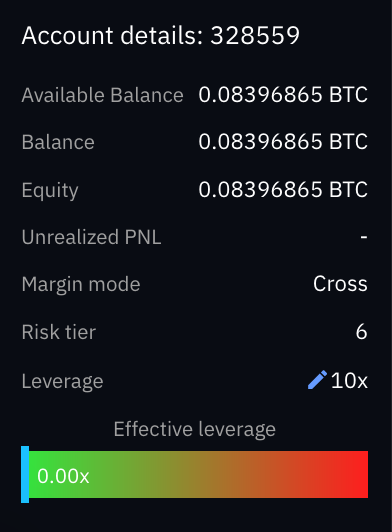

To set your leverage, go to the “Account details” section found below the New Order panel. Click on the pencil icon on “Leverage,” choose your leverage option (10x in this case), and click “Save.”

Step 6. Finalize your order.

Take one last look at your order details before confirming your order. Here, you are buying 1 BTCUSD contract at the market price. Because this market order is at 10x leverage, you will only need 482.68 USD (required margin) in your account to open this position. When everything is set, click on the Buy button, and you’re done.

Step 7. Check your history.

You can find all your transactions and history just below the charts. Check how your trade is performing. You can see your unrealized profit or loss in real-time. You can also see the liquidation price or the price at which the position will automatically close. If you want to lock your open order manually, just click the “x” mark at the end of the row.

Profit/Loss Scenarios on PrimeBit

Let us look at situations when a trade results in a gain or a loss.

In this example, we will set a market buy order of 1 BTCUSD valued at $7000 and with 10x leverage. Here, you are buying because you think that the price of Bitcoin against the USD will go up. When trading at 10x leverage, you only need $700 as a margin to open this position.

| (Go, Long) Market Buy Order with 10x Leverage | |||

| Price Change (%) | New Price (USD) | Profit/Loss (USD) | Profit/Loss (%) |

| 100% | $14,000 | $7,000 | 1000% |

| 50% | $10,500 | $3,500 | 500% |

| 25% | $8,750 | $1,750 | 250% |

| 10% | $7,700 | $700 | 100% |

| 5% | $7,350 | $350 | 50% |

| 2% | $7,140 | $140 | 20% |

| 1% | $7,070 | $70 | 10% |

| -1% | $6,930 | -$70 | -10% |

| -2% | $6,860 | -$140 | -20% |

| -5% | $7,000 | -$350 | -50% |

| -10% | $6,300 | -$700 | -100% |

| -25% | $5,250 | -$700 | -100% |

| -50% | $3,500 | -$700 | -100% |

| -100% | $0 | -$700 | -100% |

As you can see, when you trade with leverage, and the market favors you (price increased after you buy), your profit potential can fly. Whereas, when the market goes against you, your loss is limited only to that $700 that you initially invested.

Let us say that you think that the price of Bitcoin against the USD will go down. In this case, you would want to sell early in the hopes of buying later when the price is low. Here, we want to sell 1 BTCUSD valued at $7000 with 10x leverage. The same as the previous example, you need to have $700 in your account to open this position.

| (Go Short) Market Sell Order with 10x Leverage | |||

| Price Change (%) | New Price (USD) | Profit/Loss (USD) | Profit/Loss (%) |

| 100% | $14,000 | -$700 | -100% |

| 50% | $10,500 | -$700 | -100% |

| 25% | $8,750 | -$700 | -100% |

| 10% | $7,700 | -$700 | -100% |

| 5% | $7,350 | -$350 | -50% |

| 2% | $7,140 | -$140 | -20% |

| 1% | $7,070 | -$70 | -10% |

| -1% | $7,070 | $70 | 10% |

| -2% | $7,140 | $140 | 20% |

| -5% | $7,350 | $350 | 50% |

| -10% | $7,700 | $700 | 100% |

| -25% | $8,750 | $1,750 | 250% |

| -50% | $10,500 | $3,500 | 500% |

| -100% | $14,000 | $7,000 | 1000% |

After shorting with 10x leverage and the market moves to your favor (price decreased after you sell), then you will reap your multiplied earnings. However, if the price increased, you are likely to lose part or all of your initial deposit.

Tips to Mitigate Risks

Leveraged trading can be enticing, but proper risk management is key to achieving successful trades. Here are some tips and tricks:

Practice trading with demo accounts – PrimeBit offers a fully-featured demo account where traders are given mock funds so they can do simulated trading with real market data. Beginner traders can familiarize themselves with how the market works in a risk-free environment.

Start trading with smaller funds – If you are a novice in leveraged trading, start first with low deposits and work your way up. Doing so will limit your losses in case the market goes against you. Do not be discouraged in your early tries.

Use risk management tools – Use stop loss or take profit levels to reduce the risk of losing too much in case the market goes against you. These are preventive measures tide up to an open position to automatically close it at your specific conditions. Be realistic in setting stop loss and take profit levels so you can always end up profiting.

Leverage with care – Leveraged trading can greatly amplify gains. However, you still need to protect your capital while planning your strategies to earn more. To minimize the risk of losing your initial funds, start by trading with low leverage. This way, you limit potential losses while learning how to use leverage to your advantage.

Plan your trades – The crypto market is full of probabilities. To ensure a successful trade, build a game plan, and establish your rules. How will you diversify your portfolio? How much of the balance are you willing to risk? Do you calculate your risk/reward ratio? When will you open a trade? When will you close it? Having a trading plan and sticking to it will keep your emotions in check. Don’t be an emotional trader who is highly vulnerable to making mistakes.

With carefully planned trades and effective risk management strategies, you can skyrocket your earnings in no time. PrimeBit WebTrader has the best trading conditions to get you started. It is a beginner-friendly trading platform that offers up to 200x leverage, low and transparent fees, and a generous affiliate program. Registration is easy. Just sign-up with your email address and start trading! PrimeBit WebTrader has a demo account and is available in desktop and mobile versions. Visit PrimeBit for more information.